But I Have Full Insurance Coverage…Right?

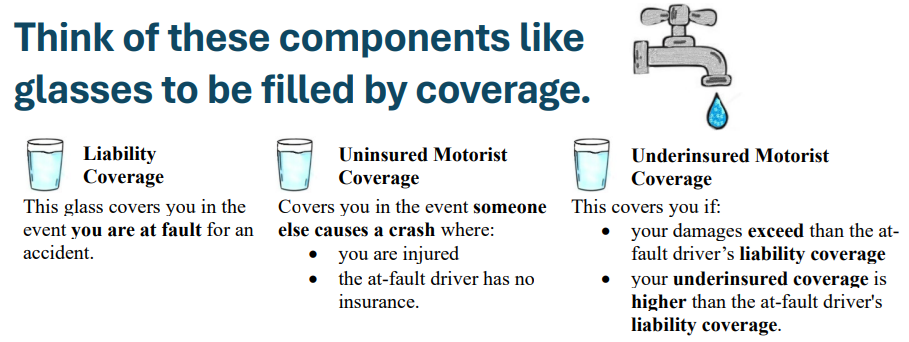

We hear clients tell us that they have “full coverage” when it comes to their automobile insurance. But what does that mean? Insurance is a product like any other. In the insurance store, the insurance product has several components.

Although having a little bit of coverage in each glass is technically considered “full coverage,” that doesn’t mean all of your “glasses” are “filled” with enough coverage.

LIABILITY COVERAGE

Illinois requires all drivers to have at least $25,000 in their liability glass to cover the damage they cause to others. That is surely not enough coverage if you have a job, house, or other assets at least $250,000 in coverage should be considered.

With the cost of medical care today, having the State minimum in coverage is like having no coverage at all.

UNINSURED AND UNDERINSURED MOTORIST COVERAGE

Put simply, uninsured and underinsured motorist coverage means your insurance company will compensate you for your damages if an uninsured/underinsured driver hits you.

In Illinois, your insurance company must offer Uninsured and Underinsured Motorist coverage equal to the liability coverage.

If you do not have this coverage and an uninsured driver causes the crash in which you are injured – YOU DO NOT HAVE INSURANCE AT ALL.

MAKE SURE YOU HAVE FILLED EACH GLASS WITH ENOUGH COVERAGE TO PROTECT YOU IN THE EVENT OF A CRASH.

Scott Barber is the founding partner and lead attorney at Barber Law Offices in Schaumburg, Illinois. With decades of experience in personal injury, workers’ compensation, medical malpractice, and civil litigation, Scott has dedicated his career to helping clients recover justice and fair compensation after injuries caused by negligence. Recognized as an Illinois Super Lawyer and a “Top 100 Trial Lawyer,” he combines compassionate representation with aggressive advocacy. Scott also teaches paralegal students at Harper College and regularly lectures to attorneys, sharing his expertise in injury law and workers’ compensation.