I Have Umbrella Insurance Coverage. That Covers All My Insurance Glasses, Right?

Most people believe that having Umbrella coverage means that all the insurance policies are covered under the protection of the “umbrella,” but that is not necessarily the case.

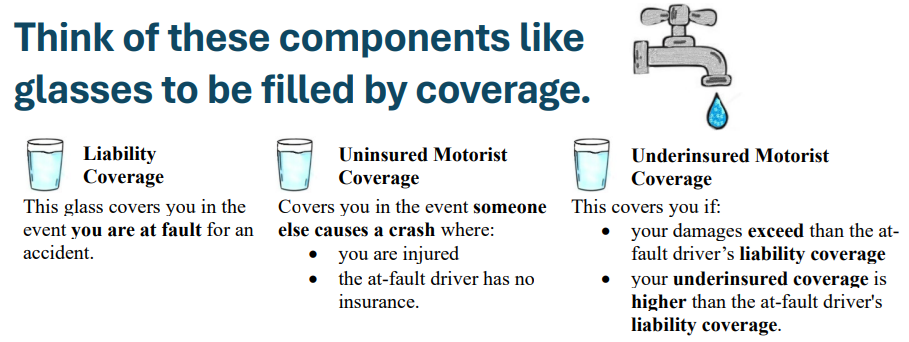

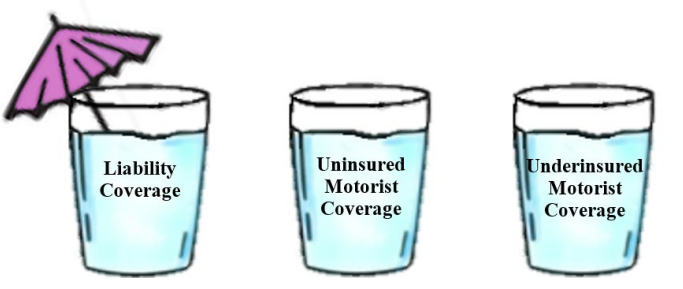

As we previously discussed in the Full Coverage Insurance blog, there are three types of insurance. Continuing with our glass analogy, the “glass” represents the type of coverage, and each glass gets “filled” with the amount of coverage.

Most auto insurance companies only offer an umbrella over the liability glass – a “drink” umbrella (for example: State Farm).

The umbrella only covers you when YOU are at fault for the collision. While that is good coverage if you are at fault, it does not cover the at-fault driver who causes the collision.

YOU MUST SPECIFICALLY QUESTION YOUR INSURANCE AGENT ABOUT YOUR UMBRELLA AND CONFIRM YOUR COVERAGE

Make sure you discuss your umbrella coverage with your insurance agent.

There is no obligation for the insurance agent to educate you about umbrella insurance coverage.

Scott Barber is the founding partner and lead attorney at Barber Law Offices in Schaumburg, Illinois. With decades of experience in personal injury, workers’ compensation, medical malpractice, and civil litigation, Scott has dedicated his career to helping clients recover justice and fair compensation after injuries caused by negligence. Recognized as an Illinois Super Lawyer and a “Top 100 Trial Lawyer,” he combines compassionate representation with aggressive advocacy. Scott also teaches paralegal students at Harper College and regularly lectures to attorneys, sharing his expertise in injury law and workers’ compensation.